Investor demands attainable growth targets with improved margins.

Activist investor Starboard has sent another letter (pdf) to GoDaddy’s (NYSE: GDDY) management and board, pushing the company to hit growth and margin targets.

The investor first revealed a 6.5% stake in GoDaddy in 2021. Last year, it sent an open letter to the company admonishing it for missing revenue growth targets and demanding that it make significant cost cuts.

In the letter, Starboard pats GoDaddy on the back for recent performance but says it’s closely watching the Q4 earnings call and March’s Investor Day.

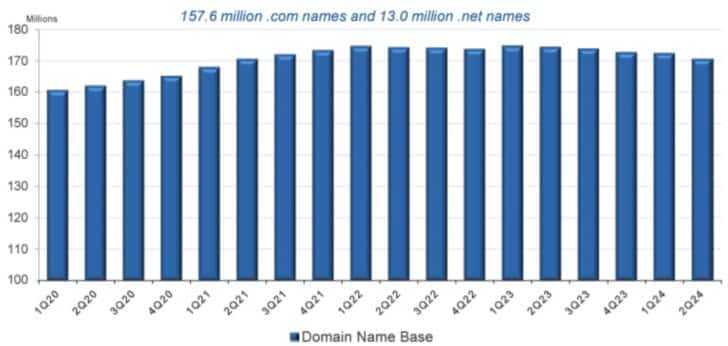

It wants GoDaddy to target a 40% growth-plus-profitability measure for 2025, which it says is in-line with peers. At the same time, it doesn’t want to see a repeat of last year’s Investor Day, in which it set growth targets that it missed. (The letter referred to 2022’s Investor Day, but the letter it sent last year was about 2023 Investor Day targets, so it’s unclear which year it’s referring to. To be fair to GoDaddy, it was very difficult to forecast growth coming out of the pandemic, which saw unprecedented demand for websites and domain names.)

Starboard continues to push for margin expansion and cost-cutting.

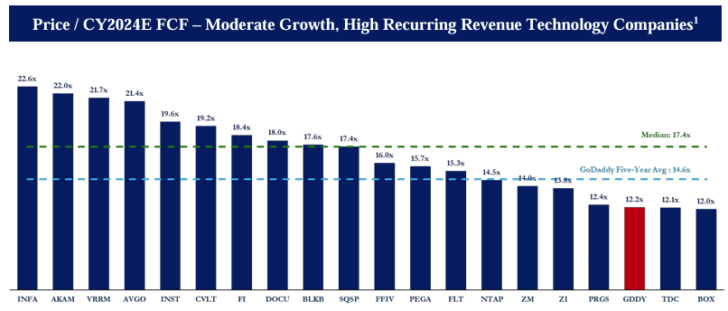

Finally, Starboard recommends that GoDaddy continue to plow free cash flows back into share repurchases of GoDaddy’s “undervalued shares”.

Post link: Starboard continues to push GoDaddy to expand margins

© DomainNameWire.com 2023. This is copyrighted content. Domain Name Wire full-text RSS feeds are made available for personal use only, and may not be published on any site without permission. If you see this message on a website, contact editor (at) domainnamewire.com. Latest domain news at DNW.com: Domain Name Wire.